Shanghai Port Congestion Weekly Update

Congestion at the port of Shanghai remains high for the time of year, but is steadily normalising as the city’s Covid wave subsides.

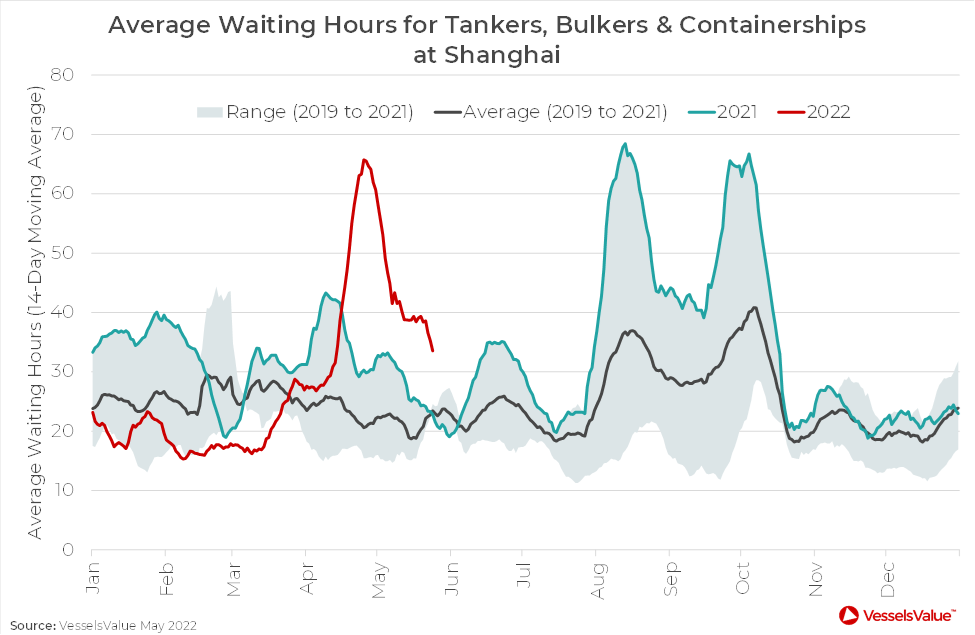

VesselsValue data shows average waiting times for Tankers, Bulkers and Containerships at the port are now down to 34 hours, from a peak of 66 hours at the height of reported Omicron case in late April, as shown in Figure 1 below. This is around 10 hours longer than levels this time last year, and the higher end of the three year range. But a resumption of the downward trend, after a slight blip in mid May, will welcome relief for supply chain planners in the region and around the world.

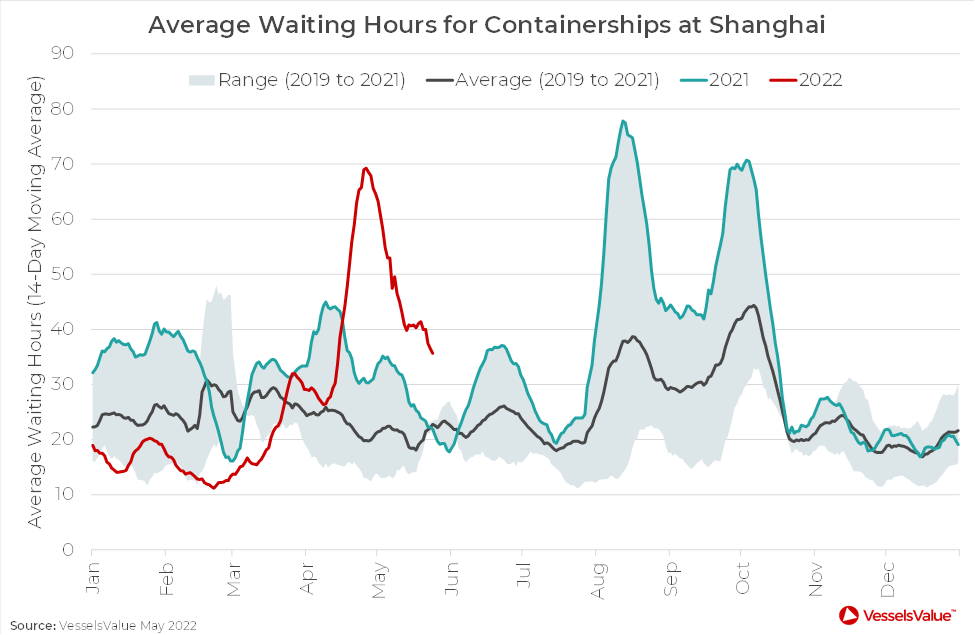

Breaking the data down by ship type, the overall trend is most closely mirrored by Containerships, the most populous ship type at the port. Average waiting times for Containerships at Shanghai are now down to 36 hours, from a peak of 69 hours in late April, as shown in Figure 2 below. This remains some 13 hours higher than year ago levels and the top of the three year range, but is also falling back towards normal levels.

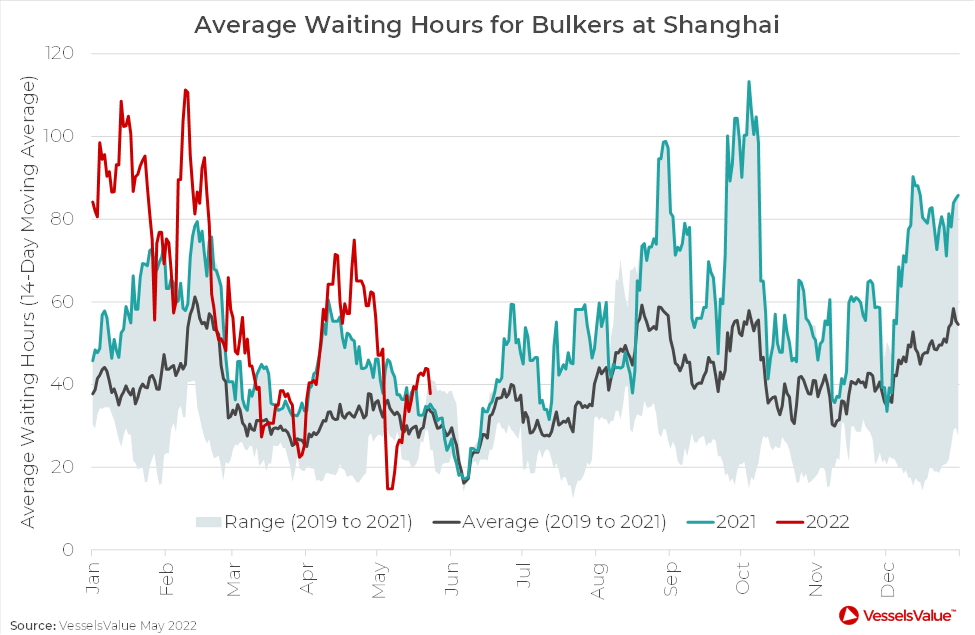

Meanwhile, congestion for Dry Bulk Carriers persists above last year’s levels and three year averages but is back within the three year range. Average waiting times for Bulkers are now down to 38 hours, as shown in Figure 3 below. This is 3 hours longer than last year’s levels and 4 hours longer than the three year average.

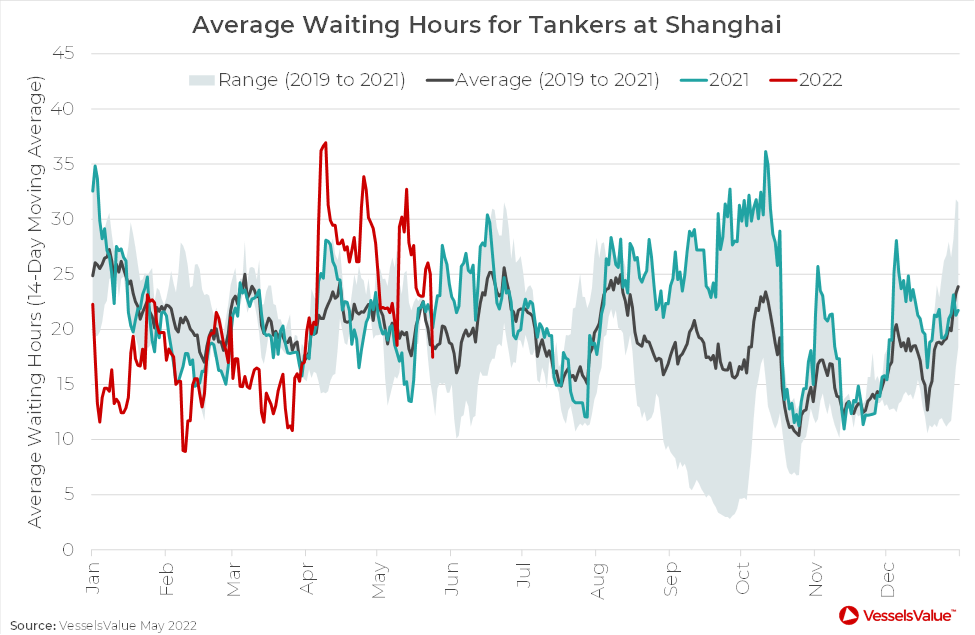

Congestion for Tankers at Shanghai has exhibited almost two months of elevated levels, but is now back within the normal range for the time of year. On average, they are waiting 18 hours at the Port, as shown in Figure 4 below. This is an hour less than the three year average.

The question now becomes whether this wave of congestion at Shanghai is having knock on effects on supply chains in other parts of the world. Anecdotal evidence suggests delays are climbing in the Panama Canal and San Pedro Bay.

If this could be of interest, please contact press@vesselsvalue.com for more information.

VesselsValue data as of 25 May 2022.

About VesselsValue

VesselsValue Ltd. (VV) is a leading online valuation and market intelligence provider for the Aviation and Maritime industries. VV went live in 2011 and has 2,500 users and works with over 500 global companies including major banks, leasing companies, shipowners, investment funds, hedge funds, lawyers, advisors and government regulators. The company has nine offices globally including London, Singapore, Shanghai, Hong Kong, and Oslo, with over 220 employees.

VesselsValue’s mission is to bring transparency and objectivity to the Aviation and Maritime markets through a wide range of services. Data and market insights are available through online access, reports, API feeds and exports, including automated values, transactions and fleet data, as well as AIS and ADS-B derived mapping & tracking, demand, utilisation and trade and people flows.

Visit www.vesselsvalue.com for more information.