VesselsValue Insights and Analytics : 2021 Port Congestion Report

Author: Charlotte Cook, Head Trade Analyst

Vessel and port congestion levels in 2021 so far have been unprecedented, significantly impacting capacity in the Container and Bulker sectors and disrupting global supply chains.

Global shipping congestion in 2021 has been profound in many ways. From Covid-19 related port disruptions, the continuation of the China/Australia Trade war causing long term delays off Chinese ports, to the ramifications of the Suez Canal blockage in March. Port congestion is yet to let up as we approach the middle of the fourth quarter in the lead up to Christmas.

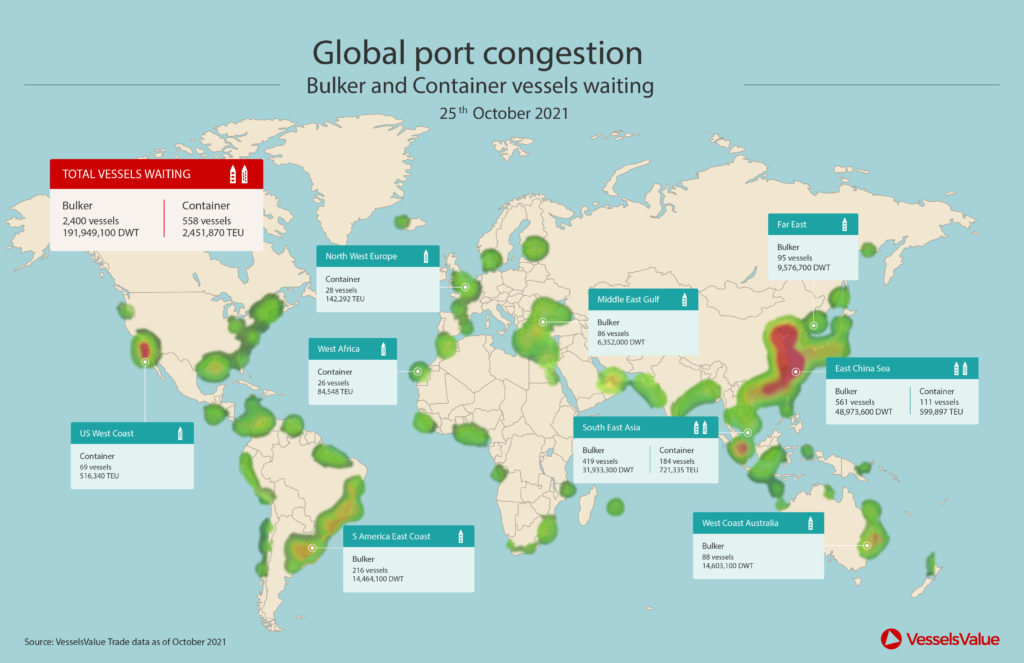

It is no surprise that shipowners and operators are anxious at the prospect of a vessel being caught in congestion, as delays to the movements of goods can often be costly and disruptive. With a total of 2,366,401 TEU (10% of the live Container fleet) and 181,635,500 DWT (20% of the live Bulker fleet) currently waiting globally, congestion is a major factor influencing vessel availability and rates, as global economies continue to recover this year in the wake of the pandemic. VesselsValue Trade and AIS data allows us to examine some of the major congestion events that have happened so far in 2021 and assess the potential impact as 2022 fast approaches.

Bulker congestion in China (2020/2021)

China/Australia coal ban creates long term congestion off China

A Chinese ban on importing Australian coal was first rumoured around July 2020, as China began to promote using domestic coal and alternative sources, as opposed to Australian exports. This caused hundreds of Bulkers from Australia to sit waiting off Chinese ports in a bid to unload their cargo.

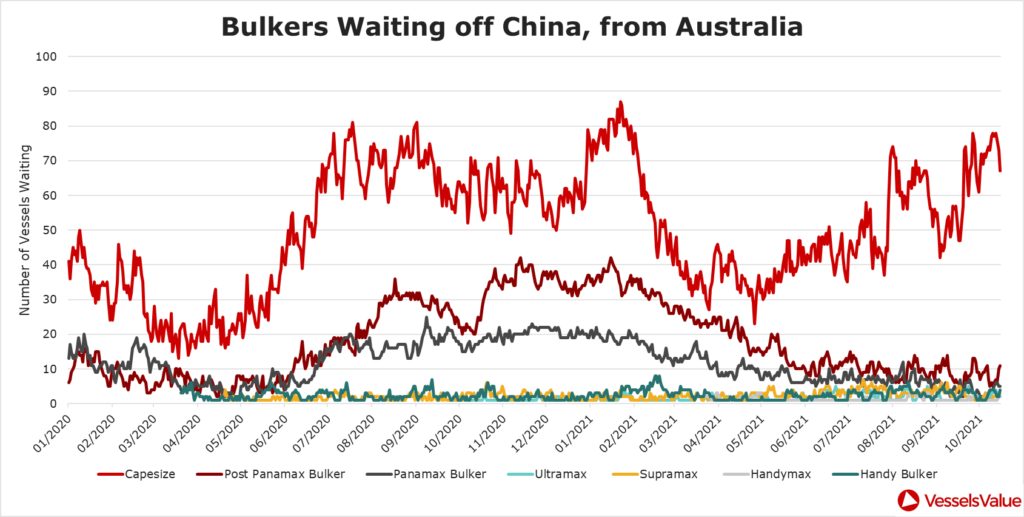

As a result, during the first six months of 2021, Capesize and Post Panamax vessels performed 17% less Australia to China journeys, carrying 14% less in cargo volume, compared to the same period in 2020. Despite a reduction in trade between Australia and China, many vessels continued their voyages to China, and this resulted in significant numbers of laden Bulkers stranded off Chinese ports, waiting to discharge their cargoes. Figure 1 shows a daily count of vessels en route from Australia, waiting off Chinese ports.

As displayed on the chart, there was a significant hike in vessels waiting off China that were likely to be carrying Australian coal between April and August 2020. Capesize, Post Panamax and Panamax types made up most of the vessels waiting, and vessel delays remained significant right into Q2 2021 when they began to fall. Since May this year, the number of Capesize waiting off China has begun to increase again, reaching similar highs to this time last year.

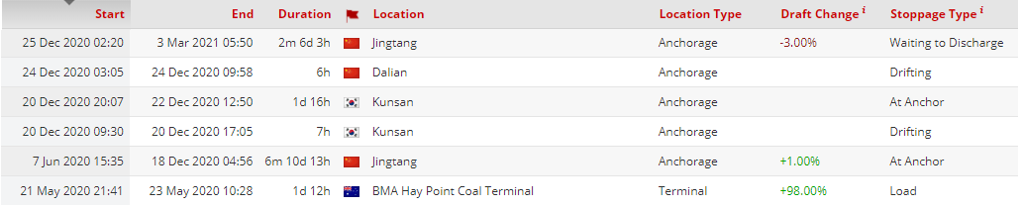

Many vessels ended up diverting away from the congested areas in China, to locations such as Japan, India and South Korea, with some performing necessary crew changes after months of waiting. The Topas (92,700 DWT Post Panamax) was one of the longest waiting laden vessels carrying coal from Hay Point (see figure 2). The vessel spent a total of over 8 months waiting off Jingtang, with a short crew change in South Korea in between anchorage stoppages.

The ban also increased journey cargo miles in the Bulker sector, as China sought to source coal from more distant locations, such as South Africa. A year on, the number of Bulkers from Australia waiting off China has reduced by around 50% as China turned to accept some of the cargoes, due to their high demand for coal power generation.

The China/Australia coal ban is a good reminder of how volatile shipping markets are in relation to geopolitical differences and demand for commodities. When vessels are waiting like this it can be costly for charterers and owners; sale and purchase contracts may already be in place with buyers and the vessel is not accruing maximum earnings while they sat idle.

Suez Canal congestion (March 2021)

The Suez Canal blockage lasted nearly a week and caused high levels of congestion as ships queued, waiting to pass the major transit zone.

The Suez Canal blockage happened back in March 2021, causing global disruption, when the Ever Given ULCV became wedged and vessels were not able to pass through one of the world’s key shipping transit zones. The blockage caused a tailback of vessels waiting to traverse at both the Southern entrance (Red Sea) and the Northern entrance (Mediterranean) of the Suez Canal, lasting 6 days in total, but the ramifications of the congestion carried on well into the second quarter of 2021.

On the 26th March, three days after the vessel first became stuck, the count of vessels waiting already totalled 169. Figure 3 shows the count of vessels waiting, split by sector and location. Out of these vessels waiting, Bulkers and Containers were most affected. On 29th March, when salvage teams finally managed to free the vessel, the count of vessels waiting rose 77%, to more than 300 vessels in total. When comparing the average numbers of vessels waiting per day in 2020 with vessels waiting on the 29th March 2021, the increase was a significant 253%.

This weeklong bottleneck caused vessels to seek alternative routes and divert around the Cape of Good Hope, taking an additional 8 days on average for a ULCV Container, costing extra time and fuel. Despite this, many vessels continued to travel towards the blockage, increasing the time it took for the canal to clear once the Ever Given was freed.

On 31st March, two days after vessels started to move through the canal again, over 50% of the original congestion had cleared. The queues for the Suez Canal at this time caused knock on effects at destination ports, as congestion shifted from the canal to the onward destination ports such as Rotterdam in Northwest Europe.

Container congestion (2021 and ongoing)

Ongoing Covid impacts and bad weather intensifies Container congestion in China

The Containership market has been under immense pressure over the past year. Bad weather and increasing spending, due to Covid-19 related pent up consumer demand, have contributed to Chinese terminal lockdowns and logistical port challenges. This has resulted in the record high levels of Container congestion, from manufacturing hubs in China to import gateways in the US and Northwest Europe.

Figure 4 shows a year on year comparison of Container vessels waiting off Chinese ports, back to pre Covid-19 2019 levels.

When comparing levels of Container congestion across China, 2021 started at similar levels to the previous two years, with the count of vessels waiting averaging just 88 per day between January and April. However, over the past six months, there has been a significant increase in the count of vessels waiting and numbers are still higher than they were at the beginning of the year.

Congestion began to worsen this year in May at Yantian port, following a rise in Covid-19 cases, resulting in China taking extra precautionary measures in ports. Further Covid-19 related terminal closures happened in China as the Ningbo Container terminal was closed for a full two weeks after an outbreak in August.

Levels of congestion in China peaked at the end of July at 361 vessels, as typhoon In-Fa struck East China, restricted access into major ports such as Shanghai and Ningbo. With vessels unable to safely enter a port, queues built up and caused further disruptions to schedules. Since then, over the past three months, we have seen Container congestion gradually decrease in China, but there are still around 180 vessels, a total of 936,073 TEU, waiting off China (22 Oct 2021). Half of which are concentrated in the East China Sea, around Shanghai/Ningbo, the other half concentrated in the South China Sea, off Hong Kong/Shenzhen.

US West Coast: Levels of congestion at Long Beach and Los Angeles remain at record highs

Levels of congestion have also risen at import destination ports, especially off the Californian ports of Long Beach and Los Angeles, as Containers waiting have continued to rise significantly since July 2021. Record high vessel counts are still waiting to unload, from Handy Containers up to ULCVs, and with the anchorages full, vessels are forced to drift further off port. There are currently around 75 vessels (see Figure 5) still delayed, which is almost 20% more than were waiting one month ago, and over 100% more than were waiting two months ago. Congestion off the port is yet to show any signs of easing and is contributing to the lack of vessel capacity that we are currently seeing globally, putting pressure on ever tightening rates. In October, Post Panamax rates have reached a staggering $130,000 per day, over a 300% increase compared to this time last year.

Most vessels waiting have travelled on the Transpacific leg from Asian manufacturing ports, with some having left over a month ago. The Zhong Gu Jiang Su (4,860 TEU) is the longest waiting vessel (25 Oct 2021), having arrived on 13th September 2021 after leaving Qingdao, China, on 29th August 2021. The average waiting time that was just over 6 days a month ago, has now risen to over 8 days.

During periods of high congestion, ports are utilising as many terminals and berths as possible to maximise throughput, but this can often add further pressure on port operations and increase port call durations, causing waiting times to increase further. The ports are still struggling to keep up with the throughput, forcing them to operate 24 hours a day to clear backlogs of container boxes. Ports are also de prioritising returning empty Containers back to Asia, with many import ports having storage yards full of empties. This means origin ports are lacking Containers to refill with goods, causing further delays and increased costs.

Onward supply chain issues are also contributing to the port congestion, with truck drivers unable to clear the sheer number of Containers in the port and delays in moving Containers from storage yards. With 40% of containerised goods entering the US through Long Beach/Los Angeles, these hold ups are significant to US imports. This congestion is expected to remain for a while, with 46 more Container vessels currently en route to reach Long Beach/Los Angeles in the next two weeks.

UK: Felixstowe port starts to feel the pressure

Delays are being seen more recently in the UK as well, as retailers aim to fill shelves in time for Christmas. Much like US West Coast ports, the majority of Containerships into the UK are transporting manufactured goods from export hubs in China, ranging from toys, fitness equipment, electricals and clothing to frozen food, with 40% of the UK’s containerised imports moving through Felixstowe alone. The port has received around 45% less Containerships this month compared to the same period in 2020, and around 50% less than the same period in 2019. This suggests that the port is struggling with turnaround times, as a severe shortage of HGV drivers and terminal congestion means containerised goods are not leaving port quickly enough to clear space for a steady flow of new containers.

Some shipping lines are diverting ships to other European ports to avoid the Felixstowe bottleneck and keep vessels moving. Marchen Maersk (18,340 TEU) was sailing en route from Tanger Med, changing course from Felixstowe to Wilhelmshaven, Germany, on the 13th October in a bid for a faster discharge. Things that take longer tend to cost more, so being forced to make decisions to change vessel itineraries and getting held up in congested ports can be costly for shipping lines.

These factors are causing more and more issues for retailers and consumers, with multiple reports of goods being held up in later stages of supply chains, threatening Christmas and Thanksgiving deliveries during the busiest period of the year. Retailers make the biggest proportion of the sales at this time of year, so if retailers struggle to source enough stock and profit margins lessen, we could see the price trickle back to the consumer. We may also see an increase in the use of alternative modes of transport to get products in stores, such as rail and air freight, although distribution issues are simultaneously impacting most parts of the supply chain.

Summary

There have been several stand out events so far this year that have resulted in shipping sectors becoming subject to congestion. Some were relatively short lived, such as the disruption from the Suez Canal blockage, others have been more prolonged, such as the China/Australia coal ban which has spanned over a year.

As with many industries, Covid-19 has also had pronounced impacts on shipping congestion globally so far this year.

After the Container sector came to almost a standstill last summer, pent up consumer demand and stimulus spending implemented in some economies caused a resurgence in the need for Container shipping globally, at a fast pace. Asian Container terminals have battled with ongoing Covid-19 restrictions, limiting the flow of exports at times, and import hubs have been forced to quickly react to levels of congestion never seen before.

Port congestion has not only played a part in influencing vessel rates but has also had knock on impacts further down supply chains, as transportation links struggle to keep up with bottlenecks and throughput.

It may be that we see a lull in demand in the New Year, with the Christmas period ending and Chinese New Year. This could ease congestion slightly, although with the high number of vessels still waiting, it’s likely the backlog of vessels will extend at least into the second quarter of 2022. With a reduction in available capacity on the water and staggering numbers of newbuild orders this year (570% higher than orders in 2019), we have seen Container rates climb to record highs, with current congestion supporting the incline.

VesselsValue data as of 25th October 2021.

Download the report in PDF here

About the author :

Charlotte Cook – AIS and Trade Manager

Charlotte Cook – AIS and Trade Manager

Charlotte Cook heads up the AIS and Trade research departments at VesselsValue, overseeing the maintenance and advancements of the databases. Charlotte is experienced in large scale data analysis, with a focus on AIS, global trade flows and maritime infrastructure, working closely with Analyst and Development departments in the design, testing and launch of Trade related products and services. Prior to joining VesselsValue in 2016, Charlotte attended Portsmouth University graduating with a BA(Hons) in Geography.