Energy Efficiency White Paper, EEDI/EEXI overview, analysis and impact

Industries across the world are contributing to the vast effort to combat global climate change, and Shipping is no different. To achieve a significant reduction in emissions, the International Maritime Organisation (IMO) has committed to the ambitious and important policy of decarbonisation, with the goal of using international regulations to reduce the amount of carbon dioxide (CO2) emitted by Shipping. Specifically, by 2050, it aims to reduce both Maritime emissions and their CO2 intensity by at least 50% and 70% respectively, compared to 2008 levels.

The IMO will primarily be introducing limitations on technical and operational inefficiencies. At the forefront of this drive is the Energy Efficiency Design Index (EEDI), and the Energy Efficiency Existing Index (EEXI).

These indices are calculated for every cargo ship above 400GT (EEDI applies to vessels built after 2013, and EEXI to vessels built before 2013). The index is a measure of the number of grams of CO2 emitted per tonne mile (gCO2/ton mil) by the engine. The indices factor in a large number of variables associated with a vessel’s specifications.

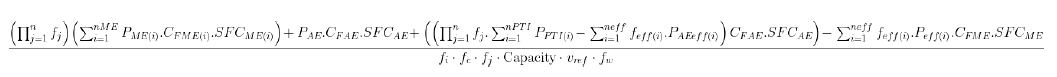

The official equation used to calculate EEDI/EEXI is shown in Figure 1:

This formula pulls from a variety of data streams, ranging from official reports to estimation models. To reduce emissions, the IMO has mandated that a vessel’s Attained EEDI/EEXI value must fall below a Required value. What’s more, this regulation is being made more stringent over time, by the lowering of these Required values in phases since 2013. EEDI came into force in January 2013, and its counterpart, EEXI, will come into force in January 2023, increasing the scope of this regulation to encompass almost the entire cargo fleet.

Understandably, the complex methodology of this regulation has been the subject of much scrutiny from shipowners, charterers and other key players in the industry. The implications for non compliant vessels are still unclear, as the IMO is yet to detail the penalty for breaching this regulation.

In response to these regulations, VesselsValue now provides EEDI/EEXI values for each Bulker, Tanker and Container vessel, using our extensive databases, technological infrastructure and expertise. Our Energy Efficiency services also provide the user with customisable inputs for real-time calculations and outputs to help monitor and measure vessel and fleet ratings.

EEDI/EEXI Fleet Breakdown

Overview

Across the cargo fleet (Bulker, Tanker and Container), only 21.7% of vessels currently stand to comply with EEDI/EEXI regulations. Bulkers are the least compliant vessels, followed by Containers and then Tankers, the latter of which have the highest levels of compliance.

Figure 2 shows a breakdown, by type, of EEDI/EEXI vessel compliance.

It is important to note that VesselsValue uses the IMO calculation for reference speed, meaning the percentage of compliant vessels has the potential to be slightly different in reality, due to the IMO’s method using reference speeds that are typically lower end estimations. Despite this, the proportion of compliant vessels is still low, highlighting the scale of the decarbonisation challenge. Future punitive measures from the IMO will undoubtedly force shipowners into taking action.

Bulkers

Percentage of fleet compliant: 10.0%

Despite the fleet being relatively young, with an average live age of 11.4 years, only 1 in 10 Bulker vessels would comply with the current EEDI/EEXI regulation.

From Figure 2, it is clear that Ultramax vessels have the highest percentage of compliant Bulkers (32.8%), which is unsurprising given the average age of a live Ultramax is only 5.4 years. Capesize vessels come in second at 21.6% as, naturally, larger vessels can move more tonnes of cargo per gCO2 than smaller vessels.

Containers

Percentage of fleet compliant: 25.6%.

Based on mean EEDI/EEXI, Container vessels are among the largest CO2 emitters, producing on average 18.3 gCO2/ton mil. This is most likely due to the larger, more powerful engines required for their typically faster trading speeds.

If shipowners attempt to correct this and decide to decrease installed engine power and therefore reduce optimum speed, already stretched supply chains could come under even more pressure.

As shown by Figure 2, ULCVs have the highest percentage of compliant vessels (83.5%) overall, by a significant margin. This is due to both their low average age of 5.3 years and large size, allowing more cargo to be carried which leads to a higher efficiency of cargo transportation.

Tankers

Percentage of fleet compliant: 30.4%

Despite the Tanker sector having the largest number of compliant vessels, a minority of fuel inefficient Small Tankers raise the mean EEDI/EEXI of Tankers to 14.7 gCO2/ton mil, a stark difference compared to the Bulker average of 4.6 gCO2/ton mil. The non compliant Tanker fleet has an average age of 16.6 years, compared to the compliant Tanker fleet, which has an average age of 12.5 years (4.1 years younger). Younger vessels are more likely to be fitted with more efficient engines and Energy Saving Devices (ESDs).

How will this affect the fleet?

EEDI and EEXI will likely have a significant impact on the cargo fleet. Vessels that don’t meet the Required EEDI/EEXI value, particularly older tonnage, may be challenging to finance. Shipowners wishing to reduce their installed power to stay compliant may find they are forced to reduce their speeds, thus increasing journey times, affecting charter rates and shrinking the vessel’s earnings.

In order to remain compliant and productive, retrofitting may become the norm for non compliant vessels close to the Required EEDI/EEXI. These vessels could see themselves upgraded with a host of Energy Saving Devices (ESDs). This includes an extensive list ranging from air stream hull lubrication systems to propeller fins, or even the addition of wind propulsion and solar cells. We may see a variety of new technologies developed with the aim of increasing existing vessel efficiency, leading to a potential boom in Maritime engineering.

For vessels that are further away from achieving compliance, Engine Power Limitation (EPL) alongside the installation of ESDs is likely to be the most powerful option. EPL limits the maximum achievable power of the engine, and therefore the top speed of the vessel. This procedure not only costs the shipowner money, but also means their vessel will operate slower and potentially suffer reduced earnings as a consequence.

As for newbuilds, EEDI and EEXI measures will accelerate the already expanding demand for alternative Maritime fuels. As a cleaner burning fossil fuel, LNG (Liquefied Natural Gas) is primed to become the main fuel for oceangoing vessels in the future, with low carbon intensive alternatives increasing in popularity across the upcoming decade. These could include bioLNG, a natural gas developed from biomass which is by definition carbon neutral, and so called ‘blue methanol’, a hybrid fuel produced from both organic and inorganic feedstock. CO2 free alternatives such as Hydrogen fuel cells and Ammonia engines, whilst still under development, could also offer a promising long term solution to decarbonisation.

Beyond Energy Efficiency Indices

As previously mentioned, Energy Efficiency Indices are only one aspect of the IMO’s two pronged efforts to curb Shipping’s greenhouse gas emissions. In 2023, alongside the introduction of EEXI, the Carbon Intensity Indicator (CII) will come into force.

This operational measure seeks to limit the inefficient operation of vessels and could compound the effect of EEDI/EEXI on carbon intensive tonnage, potentially forcing owners to choose either upgrading or scrapping portions of their older, non compliant fleet. Adding to this, regulations on NOx and SOx will clamp down on other pollutants, pushing Shipping towards a greener landscape.

Sustainable considerations have also reached the Offshore sector, where technological adaptations like Carbon Capture and Storage (CCS) can prevent CO2 emissions produced during oil and gas production from entering the atmosphere.

Alongside this, the use of solar and wind power generation on Offshore oil and gas production facilities can increase Offshore sustainability. More efficient drilling wells combined with improved reservoir basin modelling can result in fewer wells drilled per unit of production, reducing the impact of the oil and gas industry on the marine environment.

Due to recent technological advances and increased government funding, Offshore wind energy is becoming a major player in providing global Green energy.

According to the International Energy Agency (IEA) the amount of Renewable energy produced globally by 2050 must increase by 50% to achieve net zero emissions targets. VesselsValue has turbine infrastructure data on 1,200 global wind farms around the world, as well as other associated Renewables including solar and tidal projects.

What VesselsValue offers

In order to provide the transparency necessary to successfully navigate the many sustainability developments occurring across the Maritime industry, VesselsValue

offers users a variety of Green tools and functionalities. These services will enable users to access and compare EEDI/EEXI values at a fleet or vessel level, search by Green specifications, monitor Offshore Renewable projects, and track vessel activity in Emission Control Areas.

Energy Efficiency Rating and Fleet Comparison Tool

VesselsValue’s Energy Efficiency tool simplifies the EEDI/EEXI calculation and shows the user how a vessel’s EEDI/EEXI performs relative to Required values, as well as model how changes in specifications will affect this result. Key variables can be customised to fully understand how each adjustment will impact a vessel’s EEDI/EEXI value. Furthermore, the Comparison Tool allows users to view how vessels fare in comparison with the rest of the fleet, and what can be changed to bring vessels into compliance.

For individual vessels, the following EEDI/EEXI data is provided:

- Attained EEDI/EEXI: The Energy Efficiency index achieved by the vessel, based on all available technical specifications.

- Required EEDI/EEXI: The maximum permissible value of the Attained EEDI/EEXI, set by the IMO, calculated separately for every sector, based on Deadweight Tonnage (DWT), build year and other parameters.

- Distance to reference line: The percentage difference between the Attained and Required EEDI/EEXI. Reference line refers to the curve as a function of DWT which generates Required values.

For further insights into the factors affecting a vessel’s EEDI/EEXI outcome, the parameters that feed into the equation are customisable and editable on the client dashboard. This layout displays specifications including DWT, age, type, engine details such as model, power output, specific fuel oil consumption, and mathematical terms such as correctional factors and fuel coefficients.

The Comparison Tool enables users to:

- Compare the EEDI/EEXI values of multiple vessels, allowing users to identify where specific vessels stand with respect to fleets and portfolios.

- View a breakdown of compliance percentages and identify the best and worst performing fleets and sectors.

- Access real-time EEDI/EEXI values of cousin vessels in the global fleet, as well as performance data such as median values, alongside best and worst performing individual vessels.

Summary

Whilst decarbonisation may present a challenge to Shipping, it also represents enormous opportunity to optimise vessels and fleets for efficiency, sustainability and productivity. Successful sustainable Maritime development will be fundamentally data driven, and to get ahead of the curve, reliable and accurate information is key.

Download Energy Efficiency White Paper_EEDIEEXI overview, analysis and impact

Author: Joey Daly, Cargo Analyst